This is the third article in a series by my friend, Dr. Jeff Devens. He’s a humble, extremely knowledgeable advocate for overseas investors, with an impressive knowledge about investment fees, US taxes and Roth 401(k) plans for educators overseas. This third article focuses on Roth 401(k) plans for American teachers overseas. He explains how they work, while digging into the legality of these controversial schemes.

Twenty-seven years ago, we accepted our first international teaching assignment. What began as a two-year posting turned into a career. We've worked with wonderful kids and colleagues, lived in fascinating countries, forged lifelong friendships. We’re also raising children and experiencing many things that folks in the United States can only dream of. Along the way, we've made sacrifices, including being separated from family and isolated from our familiar culture. We’ve experienced language barriers, and potentially lost economic opportunities.

What have we potentially lost, economically, by not remaining in the United States? During our time abroad, we have not contributed to Social Security or a U.S.-based pension program. We are, in effect, responsible for our future financial well-being.

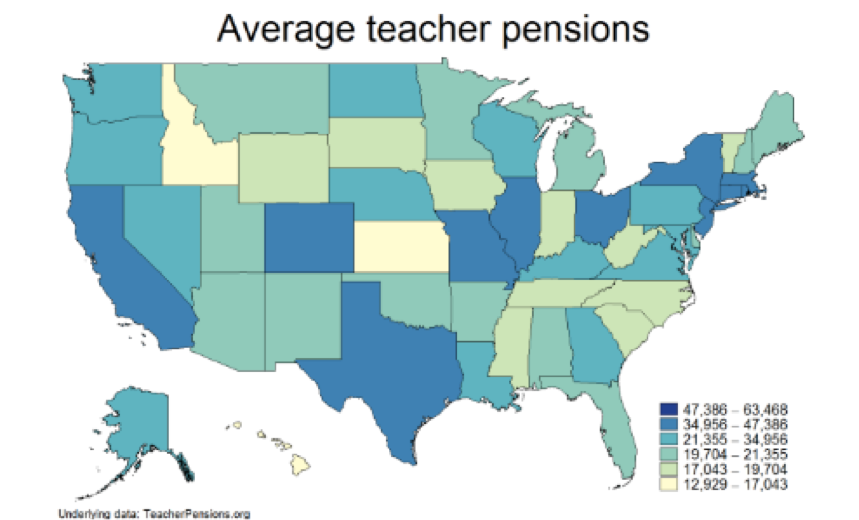

According to the Social Security Administration, in 2022, the average Social Security payment was $2,484.00 per month for Americans who are older than 65. Add a teacher’s pension of roughly $30,000 X 2 (Minnesota). That would have given us roughly $89,000 yearly. The math on this isn't precise, but it does suggest where we would be financially if we had completed our teaching careers in America.

When we make financial plans, we’re making predictions. We’re estimating what we "think" will occur in the future: stock market returns, health costs, longevity, expenses, etc. These estimates are sometimes disheartening. For example, if we wanted to spend $89,000 during the first year of our retirement, and increase withdrawals to cover inflation, we would require about $2.22 million in a diversified portfolio of index funds.

That’s based on the 4 percent rule of thumb. Backtested studies suggest that if a retiree withdraws 4 percent of their portfolio’s value during their first year of retirement, and increases the withdrawals each year to reflect the rising cost of living, the money should last at least 30 years, if it’s invested in a diversified portfolio of index funds.

But $2.22 million is a lot of money.

Alternatively, you could earn $89,000 a year if you enroll in a fixed income annuity. But if it were inflation-adjusted, you would still need close to $2 million.

Yes, that’s still a lot of money.

So, where does a person invest to obtain these sums? Most Americans use brokerage accounts, rental property, Individual Retirement Accounts (IRA), Health Savings Accounts (HSAs), and employer-sponsored retirement savings plans, like the 401(k). I'll address some of these savings/investment vehicles in proceeding blogs. This post, however, will focus on the 401(k).

The 401(k) is an employer-sponsored retirement savings account. It allows American employees to contribute pre-tax and/or after-tax dollars to various investments inside their 401(k). But it’s a controversial vehicle when combined with the Foreign Earned Income Exclusion.

Most ex-pat Americans have an opportunity to exclude a considerable amount of their salary through what is known as the Foreign Earned Income Exclusion (FEIE). This exclusion allows qualified Americans to "exclude" up to $120,000 of income from taxes in the United States for each qualifying adult in 2023. For example, if you earned $70,000 of income working at an international school in Poland, Hong Kong, or Canada, for U.S. tax purposes this income would not be counted towards your U.S. tax liability. In other words, it would be excluded because it is considered foreign earned income. This does not mean you would not incur taxes from the country you reside in. Rather, you would not owe taxes on this income to the United States.Most ex-pat Americans have an opportunity to exclude a considerable amount of their salary through what is known as the Foreign Earned Income Exclusion (FEIE).

Contributions can be made to the 401(k) pre or post-tax (up to $22,500 if 50 or younger, $30,000 if 50 or older). If a person makes a pre-tax contribution, they will lower their total reported income for calculating taxes. For example, an American employee in Dubai earns $65,000 and contributes $20,000 to a pre-tax 401(k). Their reported income for tax purposes will be $45,000. The $20,000 investment in the 401(k) grows, tax-deferred, until retirement (minimum age 59.5); whereupon, they will be assessed taxes when withdrawing funds from their 401(k) investment.

If a person contributes to the 401(k) Roth, they pay the taxes on this income prior to contributing these dollars to a 401 (k) Roth, In retirement, no taxes would be incurred on withdrawals as they initially paid taxes on these funds before investing. Using the same employee in Dubai, if they contributed $20,000 to a 401(k) Roth their reported income for tax purposes for the year would remain at $65,000.

What's the controversy?

Does the IRS allow Americans to use the FEIE, exclude ALL of their income, and contribute to a 401(k) Roth? If so, it would mean the income and earnings would never be taxed. It appears the answer is YES!

I recently read an IRS Letter Ruling issued January 2023, regarding an employee working abroad, using the Foreign Earned Income Exclusion. They wanted to contribute excluded income to their 401(k) Roth. The IRS informed him this was allowable.

With this information in mind I reached out to a podcast I follow, The Retirement and IRA Show, asking for clarification from two Certified Financial Planners ™. You can find the podcast HERE (fast-forward to 28:30, they call all people who write or call in George) where I ask them if they believed this letter ruling applies to all expat Americans who want to contribute to a 401 (k) Roth with excluded income. The hosts, cited Ed Slott, in their reply to my inquiry. Slott is unquestionably the guru of all things 401(k) and retirement savings for Americans. The host summarized Ed Slott’s analysis of the IRS Letter Ruling noting:

“…The tax code allows participants to make Roth contributions on their wages even if the employee subsequently excludes all or part of those wages from U.S. taxable income under the foreign earned income exclusion.”

I can’t overstate the importance of this ruling and its positive impact on retirement savings for Americans working abroad.

401(k) Fees

Educators who contribute to 401(k) plans will pay fees charged by plan sponsors. Some fees will be yearly, some quarterly, some based on total Assets Under Management (AUM). Others will represent a combination of all three. The U.S. Department of Labor provides a detailed outline of 401(k) plans and fee structures. I've included the link to this document HERE. Below is a summary of standard 401(k) sponsored plan fees.

• Plan administration fees. The day-to-day operation of a 401(k) plan involves expenses for basic and necessary administrative services, such as plan recordkeeping, accounting, legal, and trustee services.

• Investment fees. Plan fees and expenses associated with managing plan investments.

• Individual service fees. In addition to overall administrative expenses, individual service fees may added.

• Sales charges (also known as loads or commissions). These are transaction costs for buying and selling shares.

• Management fees (also known as investment advisory fees or account maintenance fees). These are ongoing charges for managing investment funds. They are generally stated as a percentage of the assets invested.

• Other fees. This category covers services such as furnishing statements and investment advice involved in the day-to-day management of investment products.

Why Fees Matter

Your retirement income in a 401(k) plan depends on your account balance. The growth of your retirement income is affected by contributions to your account and the earnings on your investments. But your growth gets hampered by fees. Consider an employee who is 35 years away from retirement. Their account balance is $25,000. Assuming a 7% return over the next 35 years, if fees and expenses reduce the average returns by 0.5%, the account balance will be $226,556 at retirement, even with no further contributions. However, if fees and expenses are 1.5%, the account balance will only be $162,845. This 1% difference in fees and expenses will lead to a 28% retirement account balance reduction.

Is the 401(k) Juice Worth The Squeeze?

My answer: It's complicated.

Pros:

• Roth funds will not count as part of your reported income. If you retire before age 65 and need access to low-cost-high-quality medical care, tax credits are available to offset the cost of medical care premiums; however, these credits are based on reported income. The lower your reported income, the more credits you would qualify for. Let’s use an example of a teaching couple needing $89,000 in retirement. If their reported income was $50,000 and they withdrew $39,000 from their Roth account, they would save $5,100 per year.

• Roth funds can lower reported Adjusted Gross Income (AGI). That’s a good thing. It means we might be eligible for tax credits, such as The Savers Credit, Lifetime Learners Credit, and Earned Income Tax Credits. These credits can reduce taxable income. That could save you thousands in taxes each year. For example a $2000 tax credit can reduce your taxes by $20,000 if you’re in the 10% tax bracket.

• Taxation on social security amounts will be based on reported income; however, Roth income will not count towards this. If you needed additional income and can draw this from Roth accounts it will not adversely affect your monthly social security payments. Exceptions apply to this rule

• Some schools offer a matching amount for those contributing to a 401(k) school-sponsored plan but not for other investment vehicles. Not investing in a 401(k) offered by schools may mean passing up thousands of dollars yearly.

Cons:

• Contributing to a 401(k) plan comes with fees. These fees can significantly impact retirement savings.

• If you withdrawal funds from a 401k plan prior to age 59.5 you will be assessed a 10% early withdrawal penalty on the amount withdrawn. For example, you need $25,000 and pull this from your 401k. You will pay a penalty of $2,500. Exceptions apply to this rule

• Funds left inside 401(k) plans will be charged fees even after you leave your current employer. If the funds remain in the 401(k), fees will be charged quarterly/yearly fees.

• Roth funds may have a minimum economic impact on those utilizing other investment vehicles. For example, if you are single and saved 1.5 million inside a brokerage account you could withdrawal $58,475 (married, $116,950) and pay no Federal or FICA tax. And, depending on the state you reside in, little to no state tax.

My wife and I will have spent roughly 30 years working abroad when we finish our international careers. Lord willing, we’ll have 25+ more years of living. In preparation for those years we’re learning, planning, and sharing.

In my next blog, I will address the power of Brokerage Accounts. By using a brokerage account, you could eliminate most, if not all, of the fees associated with 401 (k) plans and save hundreds of thousands of dollars in fees in the course of your career.

Enjoying the learning journey,

Jeff

For the past 21 years, Jeff has served as an international school psychologist, counselor, and educator in Singapore. In partnership with human resources, finance, and the schools Working on Wellness Committee, Jeff shares his financial educational journey with faculty, providing workshops addressing a myriad of financial topics, with a specific interest in understanding taxation mitigation strategies for Americans. You can reach him at jeffdevens4@gmail.com